Banking, Finance Regulations & Transactions

Rahman’s Chambers, as one of the leading firms in this area, provides all sorts of legal support ranging from international banking, complex trade finance, factoring, regulatory matters to security documentation etc. The Chambers have in-depth knowledge, resources, and years of expertise in different critical banking and finance matters. The Chambers for more than ten years advised banks and NBFIs on project finance, bank documentation. As a lawyer of the central bank for nearly 9 years we have advised on forex, banking regulation, credit information, Islamic finance etc. This puts us in a unique & unparalleled position to advise on all sorts of banking transactions to any client. Chambers and Partners 2023 Asia Pacific Guide for five consecutive years ranked us for Corporate and Finance. Their 2019 editorial states “Offers further capabilities in .. project finance.” Its 2021 editorial added : “It is a highly efficient team which always offers timely support.”

Rahman’s Chambers has been consecutively ranked for Corporate & Finance.

-Chambers & Partners, 2023, 2022, 2021

“…high-level opinion of them, with one of their strengths being a commitment to delivering on time”

-Chambers & Partners, 2020

“Offers further capabilities in international trade, commercial litigation and project finance.”

-Chambers & Partners, 2019

“Rahman’s Chambers handles foreign investment and disputes involving corporate transactions, finance… The ‘very responsible, responsive and knowledgeable’ Mohammed Forrukh Rahman heads the firm.”

– Legal 500, 2018

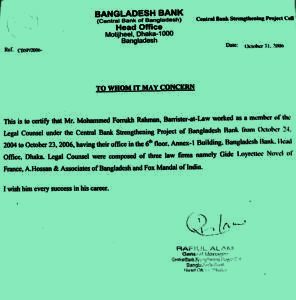

Mr. Rahman has in-depth and specialized knowledge on banking laws and regulations pertinent to his two years working experience in central bank as a member of legal counsel for A Hossain & Associates with lawyers from leading law firm of France, Gide Loyrette Nouel and leading law firm of India, Fox Mondol in a world bank-financed project on Banking laws.

The Chambers or its lawyers were involved in the following laws and regulatory drafting works for Central Bank:

- Bangladesh Bank Order (Amendment) 2009,

- Bank Company Ain (Amendment) Draft 2009,

- Financial Institutions Act (Draft) (amendment) 2009 and its translation.,

- Money Laundering and Terrorist Finance Act (Draft),

- Secured Transaction Act (Draft),

- Guideline on Islamic Banking,

- Guideline on Debt and Equity Participation & Several circulars for Central bank for CIB, BRPD, FOREX Dept, FID etc.

We are Unique because:

- We have collections of very old but valid circulars of central banks.

- We have advised on many aspects of banking e.g. regulatory, off-site and on-site supervision etc.

- We were involved in drafting major laws and circulars on banking.

- We have provided legal services for both conventional and Islamic banking

- We have significant experience of working on equity finance, project finance and corporate finance.

- We have advised a number of venture investment companies.

- We have advised on cross border claims and on international lending.

- We have experience in dealing with offshore banking and FOREX issues.

Please click below to see our completed works

- We have conducted Legal Due Diligence and also assisted a proposed bank in in preparing documents required for banking license.

- We have advised a NBFI created under bilateral investment treaty on the terms and condition of license potential breach of treaty provisions and consequence of such breach etc.

- The Chambers played a key role in drafting and negotiating factoring agreements involving trade between a Leading local bank and PrimaDollar (a British-based Finance Group) and also IFC involving account receivable finance.

- We advised a local commercial bank involving a complex cross-border dispute between a buyer, seller, and subcontractor for the supply of low-quality, defective COVID 19 related masks. We advised on FOREX regulation, refund, central bank rules & regulations, escrow account transactions, etc.

While working in the central Bank strengthening project for A Hossain & Associates in 2004 to 2006, Mr. Rahman was involved in drafting of several circulars, regulation and guidelines along with other renowned lawyers from Fox Mandal, India & Gide Loyrette Nouel, France on several matters including banking regulatory, money laundering, credit information, supervision, foreign exchange, Islamic banking etc. This in-depth knowledge and experience of Mr. Rahman clearly give an extra edge compared to other competitors in the market.

We in the capacity as a panel lawyer of central bank from 2006 to 2015 have advised central bank on several regulatory issues:

- Translating the proposed Bank Company Act 2009, Bangladesh Bank Act 2009 and Financial Institution Act 2009 from English to Bengali for Bangladesh Bank.

- Regulations involving transactions and/or drawing from the bank accounts of a company, under liquidation, with a local bank by foreign company a company incorporated in England and Wales

- Several transactions involving FOREX regulations e.g. cash incentives, international trade. Bill of lading, money exchange etc.

- Regulations involving specific transactions under EEF and grihayon fund

- Advised on several issues regulations under Money laundering

- Banking regulations involving taking deposit without having banking license.

As our private sectors clients grew, to avoid conflict of interest we had no option but to discontinue the work with central bank. Since 2016 we have advised on the below issues:

- We have advised an NBFI on compliance of Finance Company Act 2023.

- Loan security and documentation requirements under Bangladesh Bank regulations and circulars for with regard to “second mortgage”.

- Rules and Regulations for availing stimulus package made available during the COVId-19 pandemic.

- Mr. Rahman was involved in Drafting Islamic Banking Act 2006 and Islamic Banking Guidelines along with other reputed lawyers at CBSP. The firms understanding over Islamic mode of finance is notable as it often advised bank over their Islamic Finance policy from legal point of view.

Please see our practice area Cross Broder Matters

- We have advised the borrower, Dhaka RAD Elevated Expressway Co. Ltd, on project finance agreements including sponsor guarantee and Equity support & subordination agreement involving finance from local and foreign banks.

- We have advised client on Funding Agreement backed by stand by Letter of Credit.

- We conducted Due Diligence for client on matters pertaining to the fixed “Uniform Dollar Exchange Rate in Bangladesh” specifically on inward remittance, from the relevant circulars, notifications issued by the central bank of Bangladesh, namely the Bangladesh Bank (“CB”) and relevant associations such as the Association of Bankers Bangladesh Limited (“ABB”), the Bangladesh Foreign Exchange Dealers’ Association (“BAFEDA”) etc.

- We have advised and conducted due diligence for European Delegation in Bangladesh and European Investment Bank (EIB) in a project involving loan associated with climate change. The due diligence in particular addressed the compliance with EIB guideline.

Project finance agreements

- We have advised drafting/vetting of Project finance (local) related agreements like Escrow Account agreement, syndicated term loan agreement, pari passue security sharing, working capital facility, equity support and share retention agreements for the City bank Limited etc.

- The Chambers have advised an NBFI on loan security documentation under project finance involving Tk.20 Million loans.

Non PPP off balance sheet projects

- The firm acted for lenders, in few, non-PPP, off balance sheet, project finances as follows:

- Procurement, operation of a brand-new Aircraft by Biman Bangladesh Airlines Limited for amount USD$140 million only involving the Eastern bank Ltd, the lead arranger, The City Bank Limited and few other Banks.

- Hydrogen Per Oxide production plant of Fakir Chemicals Limited for Taka one billion ninety-one million for involving One Bank Limited, lead arranger and The City Bank Ltd.

- Poultry feed projects of ACI GODREJ AGROVET (PVT) LIMITED for Taka ninety-five million involving Standard Chartered bank and the City Bank Limited.

Regulation: Project Finance and PPP

- The related work experiences are as follows:

- Involved in drafting very first Guidelines for Central Bank on Debt Equity Ratio for projects seeking large loan from banks and financial institutions in 2004 based on which later guidelines were issued.

- Involved in drafting of very first Guideline on Public Private Partnership prepared by Power Division in 2007 based on which later guidelines and laws were promulgated.

PPP Projects

- Acted as Project Sponsor’s counsel and Negotiated and concluded Term Loan Facility and other security documentation between Summit Narayanganj Power Company Limited and DEG, FMO for USD 45m

- Negotiated and concluded long term financing of dual fuel power plant for USD 190m between Summit Meghnaghat Power Company Limited and the Infrastructure Development Company Limited (IDCOL), Standard Chartered Bank and a syndicate of European DFIs.

- Advised, jointly with another law firm, on finance documentation and security arrangements works involving takeover of a power project of 450MW combined cycle gas fired AES Meghnaghat Power project as financed by Asian Development Bank, as well as other lenders e.g. Infrastructure Development Company Limited (IDCOL).

- Negotiated and concluded long term financing of dual fuel power plant for USD 68 m for Ace Alliance Power Limited – with IDCOL, OFID and ICD.

- Negotiated and concluded long term financing of USD 210m for Summit Bibiyana II Power Company Limited with ADB, IFC and Islamic Development Bank.

Corporate and Structured Finance

- The firm has long experience of advising banks on several corporate and structure finance assignments.

General security documentation

- The firm as a whole has long experience of working for bank’s loan security documentation works like verification of Property Documents, search in sub-registry and joint-stock, drafting Mortgage deeds, negative mortgage, Bank Guarantee, Power of Attorneys, revocation of power, Deed of Redemption, letter of Hypothecation, deed of Floating Charges, satisfaction, modification of charges, etc and also various lending agreements e.g. term loan agreement, lease agreement, etc.

Please see our practice area Cross Broder Matters

Please see our practice area Cross Broder Matters

Practice Guide – Banking & Finance

Legal service in the area of banking finance and institutional investment is in high demand in Bangladesh. Our Central bank in specific situations allowing international banks and international agencies to give loans to local entrepreneurs. Legal service is often required on regulatory banking for such international banks and agencies. Beside syndicated loan, project finance local and foreign bank needs strong legal support. On the other hand, entrepreneurs often require legal support for regulatory issues, for example, foreign exchange, credit inflammation, general banking and finance regulation related matters. Bank and financial institutions take legal support from lawyers for security documentation, for example, mortgage, hypothecation, etc. and registration of the same. Specialized financial institutions take expert legal support for venture capital financing, equity investment, Islamic finance, offshore banking, etc. Complex transactions and investments for e.g. factoring are now slowly becoming popular due to the liberal approach taken by the central bank in recent years. Expert legal support is crucial for such transactions. For both borrower and lender recovery, related litigation is a common issue where they both require continuous legal support.

The Cabinet approved the draft of the Secured Transactions (Movable Property) Act on providing movable assets e.g., Vehicles, machinery, furniture, electronic appliances, software, agricultural products, minerals, processed fish, and livestock etc. as collateral.

Our Related Resources

We have a rich library with a mixture of printed and online legal databases. We have printed version of All England Commercial Cases, Indian Digest of Supreme Court cases, and most law reports of Bangladesh. We have a rich collection of international and local textbooks on Banking and finance matters. We subscribe to the online legal database Manuputra providing access to most reputed law reports. Read more

Our Related Resources-Consultants

We have formed a project finance practice group comprising legal and non-legal personnel. Our expert team of consultants plays a critical role in providing end to end service to the client in project finance matters.

Our Related Management

Unlike any other law firm in Bangladesh, we have almost the same number of highly skilled and efficient management personnel as that of lawyers. For Banking matters, our Accounts department plays a very important role.

Our Publications

- Article: Taking “Blank Cheque” as a security for loan (Vol. 1 of 2011)

- Article: Legal Aspects of Social Business (Vol. 2 of 2011)

- Article: Exhaustive Execution of Syndicated Loan (Vol. 2 of 2011)

- Article: House Bill of Lading: Legal Status in Bangladesh (Vol. 2 of 2011)

- Article: Judicial intervention while making payment under a Letter of Credit (Vol. 1 of 2010)

- Article: Object Clause vs. Third Party Mortgage/Guarantee (Vol. 02 of 2010)

- Article: The Role of Non-Bank Financial Institutions in the Growth of New Entrepreneurs (Vol. 1 of 2008)

- Article: Laws and Practice relating to Encashment of Bank Guarantee (Vol. 2 of 2008)

- Article: Loan recovery – Artha Rin Adalat (Vol.1 of 2007).

- Article: Creation of Mortgages (Vol.1 of 2007).

- Article: CIB reporting; List of Defaulters and Related issues (Vol.2 of 2007).

- Case Report: Name of the guarantor may appear as guarantor only in the CIB report (Vol. 1 of 2011)