BSEC has published its First Green bond gazette on 31st May 2021

Summary:

Bangladesh Security and Exchange Commission has approved the first-ever green bond issuance in Bangladesh in favor of a non-governmental organization. In its newly published gazette, BSEC has notified its nature of the bond and the type of corporations that can buy these bonds.

Content:

Starting with the introduction of Green bonds which are any type of debt instrument with the same underlying mechanism as regular bonds where the proceeds will be exclusively applied to finance and refinance in part or in full, new or eligible green projects and which are aligned with the four core components of the green bonds principles. The term ‘green bonds’ refer to the bonds that exclusively finance carbon-resilient and low-carbon projects. Besides these projects must deliver defined environmental benefits.

Recognizing its environmental benefit, BSEC regulator has taken the decision at a meeting In April that green bonds will be issued in Bangladesh. The first NGO, Sajida Foundation has availed the opportunity to raise 1 billion from the capital market by issuing green bonds for the extension of their microfinance program as well as for environmental development.

As per the guidelines provided by BSEC, the price of each bond will be 1 million with a maturity period of two years. The shares cannot be convertible into shares. Additionally, no warranty is required to issue these bonds and the money will be refunded with interest at the end of two- years.

There is also a clear instruction on who can buy these bonds, these are – public financial institutions, listed banks, mutual funds, insurance companies, cooperative banks, regional rural banks, organizations, trusts, and autonomous corporations. However, whatever companies that are interested to issue these bonds, must fulfill certain commitments to ensure environmental development.

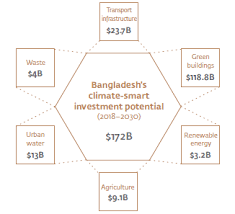

Green Bond finance can be found in several sectors in Bangladesh. Sajida Foundation will spend the money generated from the bonds on solar projects, sanitation and agriculture. Other sources where the green bond finances can be made as specified by Rezaul Karim are – renewable energy, energy efficiency, and inclusive green buildings, management of living natural and land use which is environmentally sustainable, clean water management, clean transport, climate change adaption, eco-efficient products.

For the convenience of the buyers of the green bonds, Sena Kallayan Insurance is the trustee of the bond and Standard Chartered Bank is the lead arranger of this bond. So, the interest rate can be expected to be higher than many other countries.

Pic source: Bangladesh Bank

Article source: The Financial Express

https://thefinancialexpress.com.bd/stock/bsec-approves-green-bond-for-first-time-in-bangladesh-1617810399

Leave a Reply