Plan to restructure source tax rates to aid manufacturers, traders

Summary

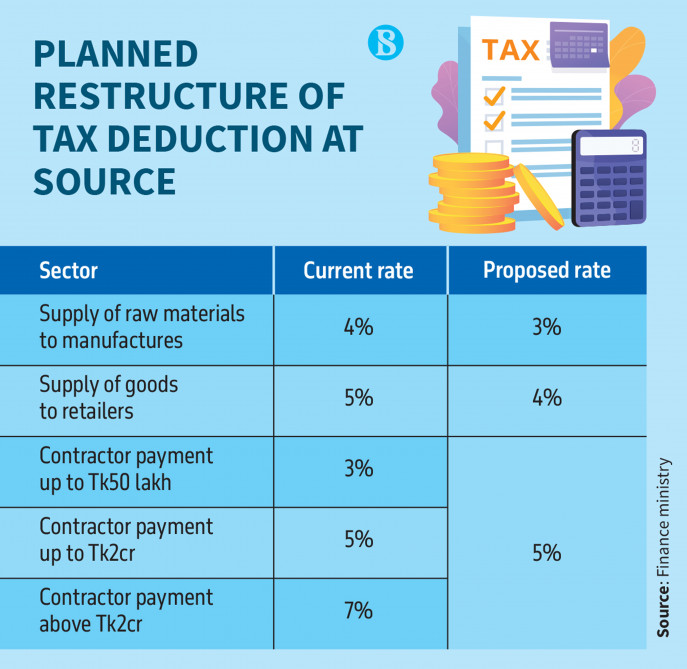

To give manufacturers and retailers some breathing room, the government is expected to lower the rates of tax deduction at source on the supply of raw materials to manufacturers and completed goods to shops in the upcoming fiscal year. Officials from the finance ministry who are aware of the situation say that the rates for supplying raw materials will drop from 4% to 3% and for trading goods from 5% to 4%.

Context:

The government is planning to impose a single rate of 5% instead of the present 3%, 5%, and 7% depending on volumes, which will result in a significant change in the source tax rate for contractor payments in the FY25 budget. Officials from the finance ministry who are aware of the situation say that the rates for supplying raw materials will drop from 4% to 3% and for trading goods from 5% to 4%. The officials from the finance ministry also went on to say that the government will provide local manufacturers and dealers comfort by treating their source tax deduction as the minimal tax and treating it as the final settlement if their income does not exceed the amount. The adjustments, according to National Board of Revenue (NBR) officials, will restrict opportunities for tax fraud when making contractor payments. Officials from the finance ministry warned that small contractors who now receive a 3% source tax rate may be impacted by the new plan to create a single rate. Former Dhaka Chamber of Commerce and Industry president Abul Kashem Khan stated to The Business Standard, “We have been opposing the idea of AIT [advance income tax] for a long time, but any move to reduce taxes is always welcome.” He added that local companies and dealers would benefit greatly if taxes were cut by 1% or 2% by the government. He proposed that the government implement a reimbursement program for taxes withheld over the real amount, stating that “otherwise, the tax burden will exceed the profit.” Snehasish Barua, a partner at the prestigious chartered accounting firm Snehasish and Mahmud Co., stated that firms would benefit from a government drop in the tax deduction at source rate. But he pointed out that small businesses would be severely impacted by a rate increase since, in certain situations, their profit margins are smaller than their taxes. The Federation of Bangladesh Chambers of Commerce and Industry director, Abu Motaleb, made the observation that the government has not been able to effectively collect taxes from the commodities that are delivered to shops. “If the government provides electronic fiscal devices to all wholesalers, it would be a solution to collect taxes at the source,” he stated. The government, apart form reducing and restructuring taxes to manufacturers and traders have also taken steps recently to reduce the tax rates on the supply of 28 necessities and food grains by half to 1% in an effort to ease the burden of consumers suffering from consistently high inflation.

Picture and Article Source: The Business Standard

Leave a Reply