Supplementary Duty and Regulatory Duty on Nearly 300 Items May Go

Summary:

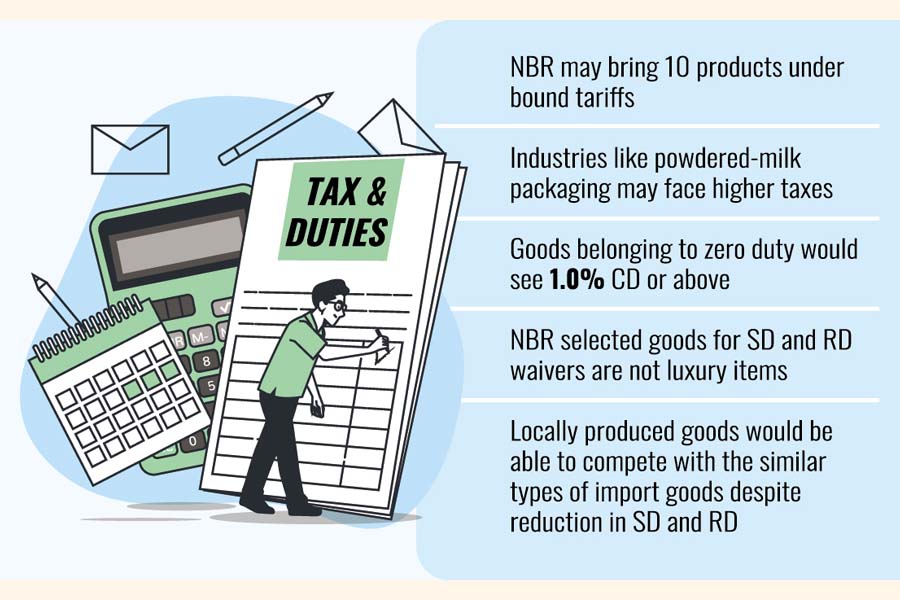

In the upcoming fiscal year, import duties on around 300 items might be combined in anticipation of Bangladesh becoming a middle-income nation, which requires tariff rationalization. Revenue Board officials have stated that the budget for the 2024–25 fiscal year will waive regulatory duties (RD) on 91 imports and supplementary duty (SD) on approximately 191 imports. Ten products may be imported under bound tariffs by the National Board of Revenue (NBR) in accordance with World Trade Organization (WTO) regulations. Certain industries, such as the packing of powdered milk, have long been subject to “illogical” tariff protection and may soon face increased charges.

Context:

In the upcoming fiscal year, import duties on approximately 300 items may be combined together in anticipation of Bangladesh reaching middle-income status, which necessitates tariff rationalization. Revenue Board officials have announced that the 2024–25 fiscal year budget will exempt regulatory duties (RD) on 91 imports and supplementary duty (SD) on around 191 imports. This fiscal policy could lower prices, but it may lead to increased competition for local businesses. Additionally, the National Board of Revenue (NBR) may allow the import of ten products under bound tariffs in line with World Trade Organization (WTO) regulations. The highest MFN tariff level for a specific commodity line is known as the bound tariff. According to the World Bank, agreements regarding bound tariff rates as opposed to actual imposed rates are reached when nations join the WTO or when members negotiate tariff levels with one another during trade rounds. Customs authorities claim that some industries, such as the packing of powdered milk, have long benefited from “illogical” tariff protection and may now have to pay higher taxes. The tax incidence on the import of 2.5 kilograms of powdered milk is currently a steep 89.32%, compared to 10% with a total tax incidence of 37% for bulk imports. The NBR may remove the 20 percent standard deviation on the import of two-and-a-half-kilogram packets of powdered milk in order to reduce the significant tax gap. This would assist in reducing the protective duty difference between bulk and package imports to 21 percent. In the next fiscal year, shelled cashew nuts might get 5.0 percent CD and 10 percent RD. Sardine and mackerel fish import taxes could increase to 58.60 percent from the current 33 percent to verify misreporting. Import duties on iron and non-alloy steel wire may increase to 43% from 37% when they leave TTI. Household water purifiers may see an increase in import duties from the current 10% to 15%, but their TTI would decrease to 37%. The current concessionary rate of 5.0 percent on import taxes may be increased to 10% for air conditioners and refrigerator compressors. Moreover, a minimum value of $40, 65, 50, and 85 may be set for imports of compressors of the kind used in air conditioners, refrigerators, and other appliances that have inverter technology or lack such technology. The minimum value required for the import of synthetic, printed, and cotton textiles may also increase. However, in order to prevent “false declarations” intended to avoid duty taxes by passing off chocolates and other food preparations containing cocoa as “food supplements,” the tax incidences on these items may be reduced from 127.72 percent to 89.32 percent. The current 10% import duties on methanol or mythail alcohol, raw materials for medicines, wood varnish, washing machines, paint, particle board, and venial board may be reduced to 5% upon repackaging. Purified terephthalic acid (PTA) and mono-ethylene glycol (MEG), which are import raw ingredients used to make polyester (a synthetic staple fiber) and pet chips (textile grade), may be subject to lower import taxes—just 1.0%, a significant decrease from the current 25% and 10%. To facilitate the import of raw materials for local carpet manufacturers, the NBR has the option to reduce import tariffs on polypropylene yarn by half, from the current 10% to 5%. If taxes were lowered to 5%, the import of manganese—which is required to make ferro alloy—might be less expensive. The total tariff amount would drop from 37% to 31%. A tax savings of 10% may be applied to import taxes on chillers (50 tones and above) used by spinning, dyeing, printing, and finishing mills. Additionally, 5.0 percent advance income tax and advance tax waivers may be waived. The current 31 percent tax on laptop imports would be reduced to 20.50 percent. Imports of spinal needles and switch sockets may be subject to higher minimum taxes. NRB officials stated that even with a decrease in SD and RD, locally manufactured items would be able to compete with equivalent sorts of imported goods. The government wants to collect Tk 1.10 trillion in import taxes in the next fiscal year. Nevertheless, import taxes account for 29% of the government’s overall tax income.

Picture and Article Source: The Financial Express

Leave a Reply