21 Insurance companies yet to be enlisted as per BSEC

Summary:

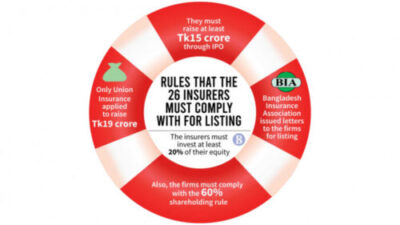

Bangladesh Securities Zone and Exchange Commission has urged 26 Insurance companies to get enlisted in the capital market among which 21 companies are still pending to be enlisted. Despite providing exemptions from the barriers of the security rules, there are certain conditions that the companies must comply with to be enlisted in the capital market.

Content:

The idea of capital market enlistment came into action on 29th Nov 2020 when BSEC issued a notification to exempt 26 companies from complying with certain provisions of public offering rules. The BSEC took the decision in response to an application by the Insurance Development and Regulatory Authority (IDRA) of Bangladesh in this regard.

For the sake of the discussion, a public offering is when an issuer, such as a firm, offers securities such as bonds or equity shares to investors in the open market. An offering occurs when a company makes a public sale of stocks, bonds, or another security. While the term offering is typically used in reference to initial public offerings (IPOs), companies can also make secondary offerings after their IPOs in order to raise additional capital.

As per the new public issue rules, any company must raise at least TK 30 crore under the fixed price method of Initial Public Offering of Bangladesh. But the commission allowed the insurance companies on the day to raise a minimum of Tk 15 crore or more through the IPO fixed price method which is exactly half of the IPO rules.

Although the capital raising has been made half comparing to the other companies, the insurance companies will have to comply with several rules to be enlisted. Among many other rules, the sponsors and the directors must jointly hold at least 60% shares of the paid-up capital of every company. Other than that the insures must invest at least 20% of their equity.

There is a discouragement among the Insurance companies because no one want to comply with the rules as per the alignment of the BSEC Chairman. For example, some companies do not want to comply with the 60% shareholding rules.

However, there are several companies that proposed to comply with the rules. Among which one of them is Union Insurance Company LTD who applied to the commission to raise TK 19.36 core capital by issuing 1.93 crore ordinary shares in the capital market. They want to invest in the FDR and purchase floor space.

Other than that, there is Best Life Insurance who want to raise TK 15 crore from the stock market already having signed an agreement with Prime Bank Investment to issue management services.

Meanwhile, SM Nuruzzaman, Chief Executive Officer of Zenith Islami Life Insurance Ltd, said the company was not able to implement its plan due to the Covid-19 pandemic.

Finance Minister AHM Mustafa said that all insurance companies would have to be enlisted in the stock exchange otherwise the licenses of these companies might be canceled.

Apart from many boundaries, there are 78 Insurance companies, among which 49

companies are listed in the stock exchange.

Article and Picture Source :

https://www.tbsnews.net/economy/stock/bsec-urges-26-insurers-get-listed- bourses-223519

and

http://www.newagebd.net/article/140966/bsec-urges-idra-to-take-steps-to-enlist-21- insurance-cos-on-bourses

Leave a Reply