Banking, Finance Litigation

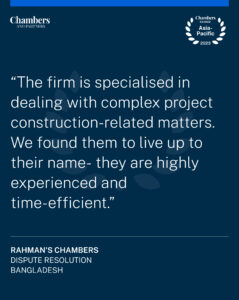

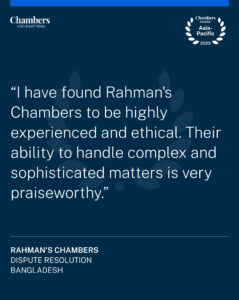

Our lawyers have in-depth knowledge, years of experience of working for the central bank of Bangladesh on different complex legal and regulatory issues and litigation. The Chambers lawyers from 2006 until 2015 represented the central bank on various complex cases where landmark judgments were delivered, involving various aspects banking and finance issues. This insight knowledge and work exposure, its rich library and other resources puts the firm in an unique position to represent clients, borrowers, leaders and international organizations involving banking and finance. The Chambers and Partners 2024 Asia Pacific Guide ranked Rahman’s Chambers for Dispute Resolution. Their editorial states: “Rahman’s Chambers houses a well-regarded litigation practice in Bangladesh with significant experience in construction disputes. Their 2022 guide also said: Possesses additional experience in land, banking and insolvency issues. ” The 2024 editorial also added “‘One source states: ‘Rahman’s Chambers’ team seems experienced and is able to smoothly deal with issues on time’ .Another client reports that the team is “excellent – always on time and very responsive and precise.”

Rahman’s Chambers has been ranked for Dispute Resolution for the third time, in addition to being consecutively ranked for two other Practice Areas.

– Chambers & Partners, 2022-2024

Mr. Mohammed Forrukh Rahman has been consecutively ranked (Band II) for Corporate & Finance.

-Chambers & Partners, 2021 & 2020

“Offers further capabilities in international trade, commercial litigation and project finance.”

-Chambers & Partners, 2019

“Rahman’s Chambers handles foreign investment and disputes involving corporate transactions, finance… The ‘very responsible, responsive and knowledgeable’ Mohammed Forrukh Rahman heads the firm.”

– Legal 500, 2018

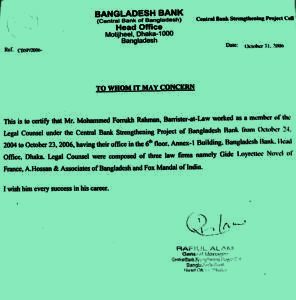

Mr. Rahman has in-depth and specialized knowledge on banking laws and regulations pertinent to his two years working experience in central bank as a member of legal counsel for A Hossain & Associates with lawyers from leading law firm of France, Gide Loyrette Nouel and leading law firm of India, Fox Mondol in a world bank-financed project on Banking laws.

We have a total of one Advocate enrolled in the Appellate Division, seven Advocates enrolled in the High Court, and four Advocates enrolled in the District Court.

Reported cases (Banking)

- LC Fraud (Hallmark case) Alvi Spinning Mills Ltd & Others vs Govt of Bangladesh and others 19 MLR(HCD)277

- CIB report (Guarantor): Anwar Cement Limited vs. Bangladesh Bank reported in 65 DLR (2013) 97; 40CLC(HCD) 2011 [As a counsel, Mr. Rahman successfully argued before Hon’ble court in a landmark case explaining the legal position of the guarantor. Mr. Rahman successfully argued the legal position as the guarantor, as per Bank Company Ain 1991 and Bangladesh Bank Order 1972 and was successful in its submission that name of the third party guarantor may appear in the CIB report however this will not stop them from taking loan from Bank.]

- Natural justice (Money Exchange License): Amjad Hossain vs. Bangladesh Bank reported in 17 BLC (HC) 188; 41CLC(HCD)2012 [On foreign exchange matter, Mr. Rahman successfully handled litigation on money changing license]

- First Security Islami Bank Ltd vs MV Javed and others reported in 69 DLR (2017) 408

- S.M. Akbar and Another vs Bangladesh Reported in 5CLR (HCD)(2017)307

Our completed works:

BANKING REGULATORY (BRPD) LITIGAITON

- We have handled cases in Company court over removal of director under Bank Company Ain 1991 involving BRPD circulars.

CREDIT INFORMATION (CIB) RELATED LITIGAITONS

- We have handled several litigations for and against Bank/NBFI involving wrongful/illegal reporting of CIB,

- We have handled litigation relating to CIB which involved complex interpretation of role of directors, nominee directors, credit reporting under Bangladesh Bank Order 1972 and Defaulting Borrower list under Bank Company Ain 1991 etc.

FOREIGN EXCHANGE (FOREX) LITIGATION

- The Chambers have handled litigation involving complex interpretation of Foreign Exchange Act 1947 and guideline impacting licensing, remittance, trade etc.

ISLAMIC FINANCE LITIGATION

- We have handled litigation involving HPSM investment involving interpretation of laws involving court jurisdiction.

LOAN RECOVERY, EXECUTION & RELATED REVISION/WRIT

- We have successfully defended clients interest before the Honble Artha Rin Court involving calculation of interest, payment adjustment, excessive claim by bank, etc. and also secured moratorium and/or payment by instalment allowing the client to deal with the insolvency situation

- We successfully invoked section 32 of Artha Rin Adalat Ain before Honble Artha Rin Court which empowered a third party to settle a claim of a bank. The matter was complex as bank denied the rights of a party who invested in a mortgaged land as a developer. The Bank was planning to sell the land by auction denying all settlement proposals based on the circulars issued by Central Bank on interest waiver.

- We have handled several litigations for and against Bank/NBFI in artha rin adalat (Loan recovery), magistrate court (cheque dishonor)executions cases, involving issuance of warrant and attachments of assets.

- We have handled several writ/revision for and against Bank/NBFI in high court arising from Arhta Rin Adalat order, magistrate court order, artha rin execution order.

EQUITY (ORDINARY/REEDEMABLE) FINANCE

- We have handled several litigation arising from equity investment of NBFI in company court, court, district/magistrate court and writ bench of High court division.

Practice Guide – Taxes & Finance (Banking & Finance litigation)

Legal service in the area of banking finance and institutional investment is in high demand in Bangladesh. Our Central bank in specific situations allowing international banks and international agencies to give loans to local entrepreneurs. Legal service is often required in regulatory banking for such international banks and agencies. Beside syndicated loan, project finance local and foreign banks need strong legal support. On the other hand, entrepreneurs often require legal support for regulatory issues, for example, foreign exchange, credit inflammation, general banking, and finance regulation related matters. Banks and financial institutions take legal support from lawyers for security documentation, for example, mortgage, hypothecation, etc. and registration of the same. Specialized financial institutions take expert legal support for venture capital financing, equity investment, Islamic finance, offshore banking etc. Complex transactions and investments for e.g. factoring are now slowly becoming popular due to the liberal approach taken by the central bank in recent years. Expert legal support is crucial for such transactions. For both borrower and lender recovery, related litigation is a common issue where they both require continuous legal support.

While working in the central Bank strengthening project for A Hossain & Associates in 2004 to 2006, Mr. Rahman was involved in drafting of several circulars, regulation and guidelines along with other renowned lawyers from Fox Mandal, India & Gide Loyrette Nouel, France on several matters including banking regulatory, money laundering, credit information, supervision, foreign exchange, Islamic banking etc. This in-depth knowledge and experience of Mr. Rahman clearly give an extra edge compared to other competitors in the market. BRPD, DBI are two major departments of central bank regulates few major banking regulation mostly related to operations of banks. Exercise of power beyond statutory limit, issuance of regulation conflicting with fundamental rights are the key issues.

One of the major achievement of the Chambers in 2011 is the reported landmark judgment of Writ Petition no. 6016 of 2008, Anwar Cement and Others vs. Bangladesh Bank and Others 2011, reported in 65 DLR (2013) 97; 40 CLC (HCD), in which Mr. Rahman have successfully represented Bangladesh Bank and Dutch Bangla Bank Limited in the High Court Division and assisted in bringing major amendment in the Credit Information reporting system for guarantor. CIB reporting is a common disputed area in Bangladesh as reporting is linked with sanctions like denial of credit extension, new credit. The reporting a a complex system susceptible to mistake and often involves issues violation of fundamental rights.

The Chambers have deep understanding and practical knowledge of entire foreign exchange regulations including inward, outward remittance, off-shore banking, trade finance, export fund, export credit etc. FOREX regulations in the part and parcel of sub-continent since 1950s aiming to regulate forex reserve. The task of maintaining delicate balance between releasing of FOREX for legitimate need and not allowing in case of non essential expenses is becoming challenging in the open market and competitive economy.

Bangladesh bank, BRPD issued a new circular in 2022 revising its circular issued in 1991 on waiver of interest. The waiver of interest on written off loans must be approved by the board of the respective bank. There are exceptional circumstances need to be considered before approving waiver. Since the existing bankruptcy law is not effective, this is circular will provide some respite for banks and customers in the exceptional circumstances. There are several litigations pending in this regard. Our apex courts often tried providing equitable remedies. It is expected that commercial banks will conduct due diligence before exercising its discretion to avoid more litigation.

Our apex court held that certification of statement of accounts made under Bankers’ Books Evidence Act, 1891 is in addition to the Arta Rin Adalat Ain, 2003 and not in derogation, hence, evidence need not be certified in view of the provision of the Bankers’ Books Evidence Act, 1891.

In 2021 our apex court also decided that under Section 33(9) of the Ain, 2003 the word ‘final’ is not absolute. Mere issuance of certificate under sections 33(5) and 33(7) of the Ain, 2003 is not enough to finally dispose of the execution case. The main purpose of the Ain, 2003 is to realize the outstanding loan of the Bank or any other Financial Institutions but not to snatch away the mortgage or any other property of the borrower.

The Chambers regularly appear in Artha Rin Adalat in both Arth Rin suit and execution suit. It has remarkable success record. Besides, Mr. Rahman in recent times handled few appeal and revision arising from execution suit in particular body warrant. On the one hand, default culture requires strict enforcement of recovery law for healthy banking system, while on the other hand, due to non availability workable bankruptcy laws, genuine businesses which are facing distressed situation, need to finds legitimate way to buy time against strict enforcement of laws.

Mr. Rahman was involved in Drafting Islamic Banking Act 2006 and Islamic Banking Guidelines along with other reputed lawyers at CBSP. The firms understanding over Islamic mode of finance is notable as it often advised bank over their Islamic Finance policy from legal point of view. The Islamic banking is becoming popular days by days not only because consumers shows interest due their religious reasons but also because it is helping both commercial bankers and consumers in the era of uncertainty of interest rate and its regulation.

Mr. Rahman handled litigation for over 5 years and successfully assisted a UAE & Bangladesh joint venture financial institution company to exit from a dredging company by selling its minority shareholder to promoters. The finance was in the mode as equity investment as opposed to a loan. Besides, in recent times the firm successfully recovered both loan and equity investment made by a US-based venture capital company from a local solar company with remarkable return nearly three times of original investment within 3 years only by ADRs. Equity investment by financial institutions are challenging because it puts them in the same footing as investor. This requires very cautions approach and strong documentation. On the other hand this is a easy source of fund very useful for companies, who do not have access to capital market. Financial institutions are only required to invest in genuine businesses to avoid the risk of habitual default.

Related Resources - Library

We have a rich library with a mixture of printed and online legal databases. We have printed version of All England Commercial Cases, Indian Digest of Supreme Court cases, Yearbook Commercial Arbitration of Wolter Kluwer and most law reports of Bangladesh. We subscribe to the online legal database Manuputra providing access to most reputed law reports. Read more

Our Related Offices

Our offices are strategically located at different places serving various goals and objectives e.g. accessibility to clients, mobility of our resources, accessibility to courts and different offices, saving time, etc. For banking matters, our Banani main office provides the most resources while SCBA setup plays an important role in urgent and critical cases.

Our Related Links

- Article: Taking “Blank Cheque” as a security for loan (Vol. 1 of 2011)

- Article: Legal Aspects of Social Business (Vol. 2 of 2011)

- Article: Exhaustive Execution of Syndicated Loan (Vol. 2 of 2011)

- Article: House Bill of Lading: Legal Status in Bangladesh (Vol. 2 of 2011)

- Article: Judicial intervention while making payment under a Letter of Credit (Vol. 1 of 2010)

- Article: Object Clause vs. Third Party Mortgage/Guarantee (Vol. 02 of 2010)

- Article: The Role of Non-Bank Financial Institutions in the Growth of New Entrepreneurs (Vol. 1 of 2008)

- Article: Laws and Practice relating to Encashment of Bank Guarantee (Vol. 2 of 2008)

- Article: Loan recovery – Artha Rin Adalat (Vol.1 of 2007).

- Article: Creation of Mortgages (Vol.1 of 2007).

- Article: CIB reporting; List of Defaulters and Related issues (Vol.2 of 2007).

- Case Report: Name of the guarantor may appear as guarantor only in the CIB report (Vol. 1 of 2011)