BSEC grants extension to 13 companies for ensuring regulatory compliance of 30% shareholder requirement

Summary:

The Bangladesh Securities and Exchange Commission (BSEC) directed listed firms to ensure 30% shareholding by sponsors and directors. Non-compliant firms, including Active Fine Chemicals and Central Pharmaceuticals, face scrutiny. The commission appointed independent directors to six firms and granted a year for 13 others to comply. Experts suggest removing non-compliant directors to protect investors. BSEC spokesperson noted ongoing efforts for compliance and potential inclusion of shareholders with over 5% shares on boards. The directive aims to hold directors accountable and stabilize the market post-2010 crash.

Content:

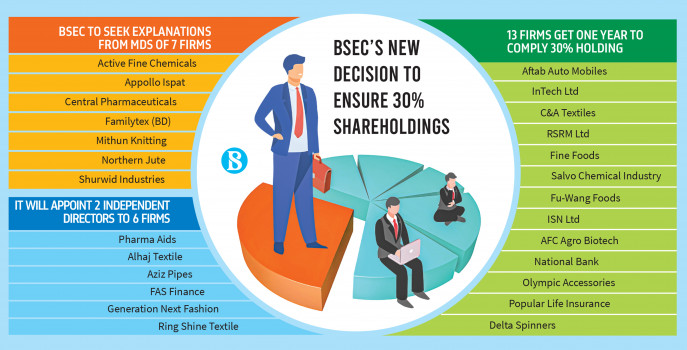

The Bangladesh Securities and Exchange Commission (BSEC) has once again emphasized the importance of listed companies complying with a minimum 30% shareholding of paid-up capital by sponsors and directors. In a recent move, the commission sought explanations from the managing directors of seven listed firms, including Active Fine Chemicals, Appollo Ispat, Central Pharmaceuticals, and others, regarding their non-compliance with this regulation.

Additionally, the BSEC decided to appoint two independent directors to six other firms, namely Pharma Aids, Alhaj Textile, Aziz Pipes, and others, to ensure better governance. Furthermore, 13 companies have been granted a one-year grace period to fulfill the requirement, as they have submitted plans to the commission detailing how they intend to comply.

This directive stems from the aftermath of the stock market crash in 2010 when the regulator introduced measures to enhance directors’ accountability and loyalty to small investors. Failure to comply could lead to legal action, as the commission has the authority to enforce compliance with regulations.

Experts like Faruq Ahmad Siddiqi, former chairman of the BSEC, emphasize the importance of the regulator communicating the reasons behind non-compliance. Abu Ahmed, a stock market expert and former Dhaka University economics professor, suggests that directors who fail to comply should be removed from their positions, as their actions can negatively impact general investors.

The BSEC spokesperson, Rezaul Karim, mentioned that some companies are making efforts to comply with the 30% shareholding rule, and the commission is monitoring their progress closely. Moreover, the BSEC is considering including shareholders holding above 5% shares on company boards to enhance governance and investor confidence.

Overall, compliance with the 30% shareholding rule by sponsors and directors is crucial for ensuring transparency, accountability, and investor protection in Bangladesh’s capital markets.

Picture and Article Source: The Business Standard

Leave a Reply