DSE is set to give compensation by using the investor protection fund to Defrauded customers

Summary:

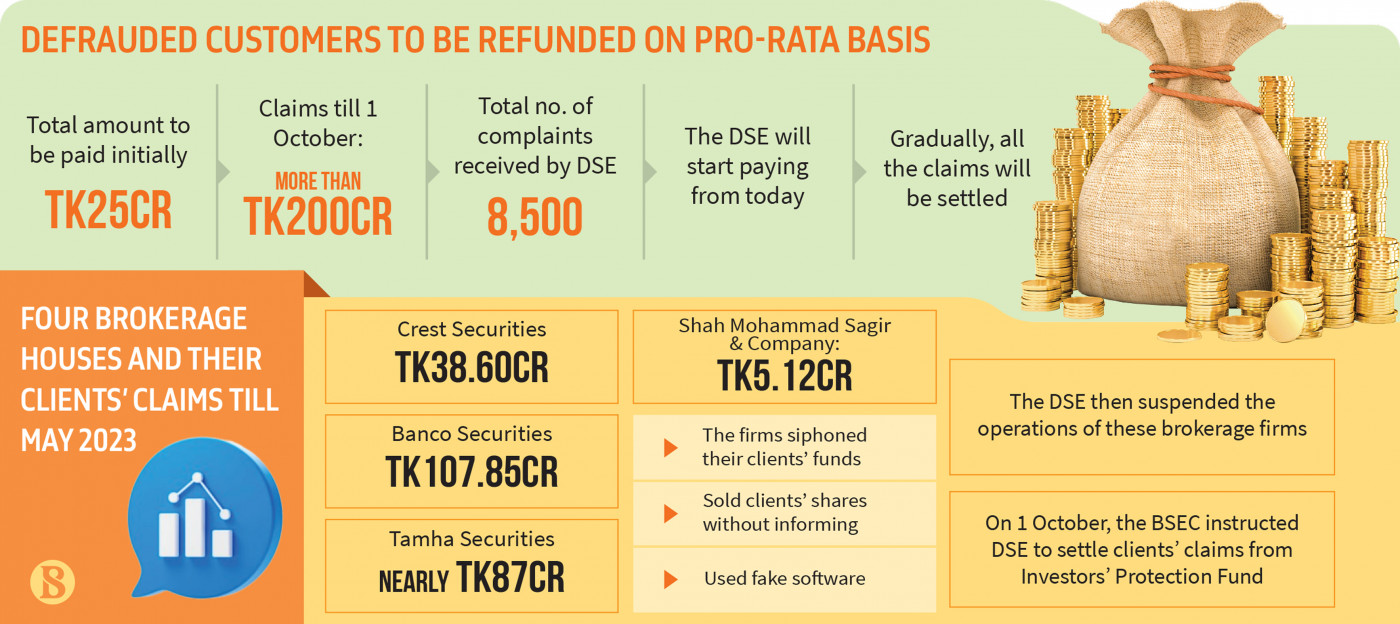

The Dhaka Stock Exchange (DSE) is set to distribute compensation to customers of four brokerage firms from the Investors’ Protection Fund established almost a decade ago.

Content:

As per the Dhaka Stock Exchange (DSE), 8,561 customers have filed claims amounting to more than Tk200 crore until 1st October this year. However, for now, the DSE will disburse Tk25 crore, which is approximately one-eighth of the total claim, on a pro-rata basis. The amount will be disbursed in such a way that the clients of the brokerage house that embezzled the most amount of money will receive the highest portion, and the clients of the one that took the least amount will receive the lowest portion.

The Depository Services Limited (DSE) is set to commence the disbursement of account payee cheques to affected customers, as part of an ongoing program. It is expected that all customers will have received the first phase payment via banking channels by the end of the week. Notably, this marks the first time that the DSE Investors’ Protection Fund, established in August 2014 to safeguard the interests of investors in the event of any default by brokerage firms, will be utilized.

According to the Managing Director of the Dhaka Stock Exchange, ATM Tariquzzaman, the process of compensating the affected investors will begin on Monday. The exchange has received a significant number of claims from customers against brokerage firms. After verifying the data, the funds will be disbursed on a pro rata basis to the affected investors as soon as possible.

Crest Securities, Banco Securities, Tamha Securities, and Shah Mohammad Sagir & Company Limited are four brokerage houses that have been in the news for defrauding their customers. DSE reports indicate that these firms sold shares belonging to their clients without informing them and also embezzled funds from the consolidated customers’ accounts (CCA). As a result, the Bangladesh Securities and Exchange Commission directed the Dhaka bourse to settle the claims of the defrauded investors from the DSE Investors’ Protection Fund on October 1st of this year.

In June 2022, DSE settled claims through Bangladesh Electronic Funds Transfer Network (BEFTN). So far, Tk4.76 crore has been disbursed to 431 investors. Tamha Securities has been accused of illegally using added software and providing fake information to clients about their investment status, resulting in an embezzlement of Tk139.67 crore, out of which Tk92.57 crore was cash and Tk47 crore was securities. Banco Securities was suspended by the DSE in June 2021 for embezzling Tk60 crore, following the discovery of a Tk128 crore deficit in the company’s consolidated customer account, which included Tk66.11 crore in cash and Tk61.97 crore in securities. Crest Securities shut down its operations and office without prior notice, and the DSE found a deficit of Tk65.30 crore in the company’s CCA, consisting of Tk44.90 crore in cash and Tk20.40 crore in securities. Shah Mohammad Sagir & Company was suspended due to its failure in trade settlements, after embezzling Tk13.74 crore.

Picture and Article Sources: The Business Standard

Leave a Reply