Exporters to induce more time to bring domestic continues

SUMMARY:

Bangladesh Bank is set to extend the due date for repatriating trade incomes by six months. It is additionally amplifying the usance period for imports by an extra six months and giving money-related motivations to settlements made by Bangladeshi troops serving UN missions in arrange to soothe the burden on outside trade saves. The Bangladesh Bank reports that the nation’s outside trade save is presently at $34.3 billion. The burden on the savings will briefly reduce if case merchants are allowed to pay for the letter of credit after one year. Ostracizes working completely distinctive countries are getting 2.50% cash inspirations for cash executed residential. But Bangladeshi nationals at the UN peacekeeping missions do not get any persuading powers.

CONTENT:

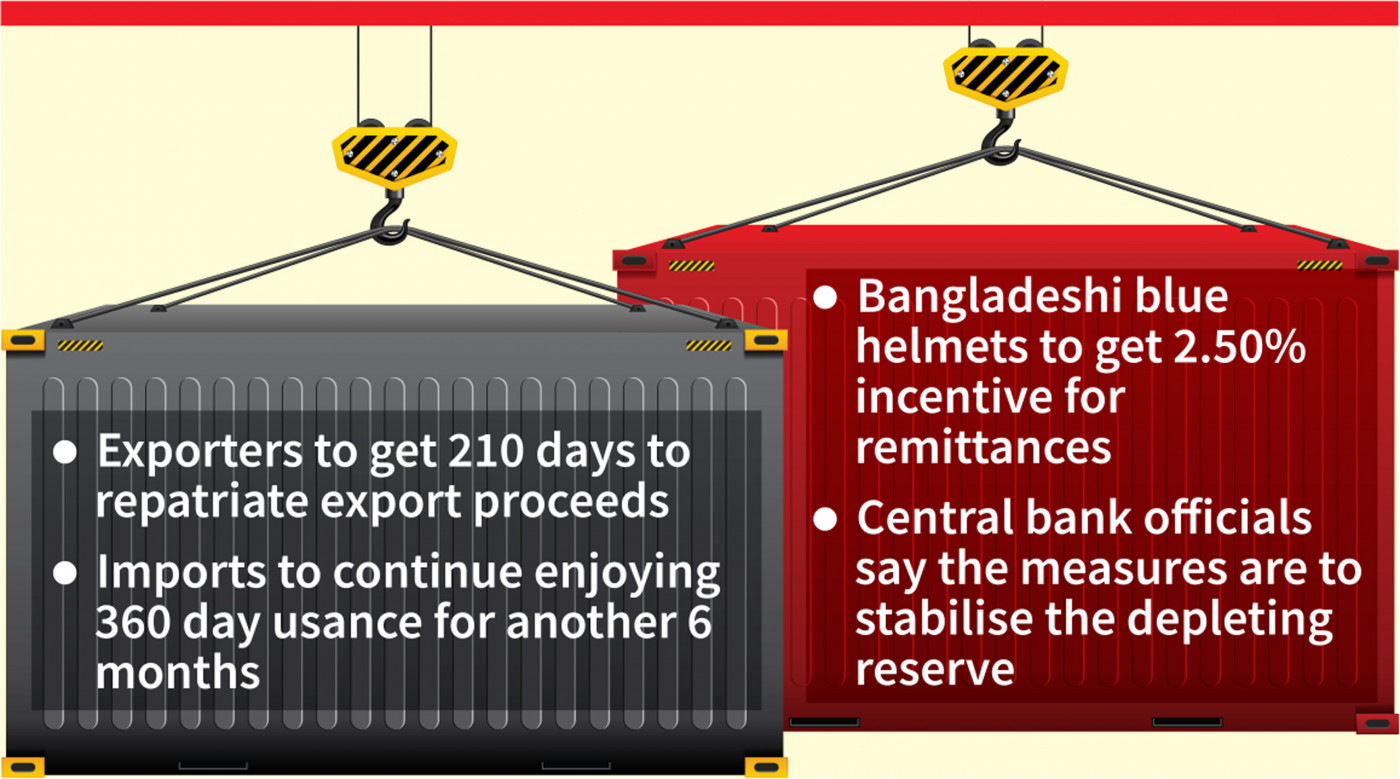

According to authorities, the central bank would prolong the current 120-day repatriation period to 210 days in order to improve the competitiveness of Bangladeshi exports abroad and ultimately increase the foreign exchange reserve.

The government would also prolong the 360-day usance period for imports by an additional six months and give monetary incentives to remittances made by Bangladeshi troops serving UN missions in order to relieve the burden on foreign exchange reserves.

According to senior officials who spoke with The Business Standard, the central bank would shortly release three distinct circulars in this respect. According to them, the Bangladesh Knitwear Manufacturers and Exporters Association requested that the Bangladesh Bank extend the deadline for repatriating export revenues.

Usually, payments for clothes products from foreign purchasers are cleared within 90 to 120 days. According to the association’s executive president Mohammad Hatem, they are now looking for extra time to pay it off due to recessionary concerns. “Already, export orders have fallen by almost 30%. The export picture might worsen more if we do not extend the payment deadline “He remarked.

The extra 360 days of usage for imports of agricultural equipment, chemical fertilizers, and industrial raw materials will expire on December 31 of this year.

The usance term was extended by the central bank from 180 to 270 days in January. The time frame was further extended to 360 days in July. The financing will now be extended by another six months by the Bangladesh Bank.

The burden on the reserve will temporarily lessen, according to central bank officials, if importers are permitted to pay for the letter of credit (LC) after one year.

The Bangladesh Bank reports that the nation’s foreign exchange reserve is now at $34.3 billion. If loans to Sri Lanka, the Export Development Fund, and other costs are left out, the total comes to roughly $26.3 billion. To close the trade gap, the central bank sells banks roughly $1.5 billion from the foreign exchange reserve each month.

The reserve will ultimately become more stable, according to central bank officials, if import payments could be postponed and more export orders could be secured by extending the period for export revenues.

Moreover, Mohammad Hatem, disagreed with that official as he said, “We are going moment raw materials from providers who concur to get the installments after 360 days.” Expatriates working totally different nations are getting 2.50% cash motivations for cash executed domestically. They get Tk107 per dollar for transmitting through the formal keeping money channel. But Bangladeshi nationals at the UN peacekeeping missions don’t get any motivating forces. Other than that, they have too advertised a lower rate of the greenback than the blue-collar specialists. But the central bank has chosen to supply them with the same motivations from presently on.

Picture and Article Source: The Business Standard

Leave a Reply