Far Chemical to merge with SF Textile

Summary:

Far Chemical Industries, a Concern of FAR Group, has decided to merge with SF Textile Industries along with the physical shifting to the second one’s own land at Rupganj, Narayanganj.

Content:

Far Chemical Industries Limited is a textile chemical-based industry, situated in Comilla EPZ, producing all types of textile chemicals needed by all export-oriented textile sectors.

They have decided to merge with SF Textile Industries Limited, a 100% export oriented yarn spinning industry on its own land in Narayanganj

SF Textile Industries is also a non-listed public-limited firm. They decided to merge with Far Chemicals, although the clauses of the merger are yet to be decided. A merger is the voluntary fusion of two companies on broadly equal terms into one new legal entity.

On a special resolution, the board of directors also decided to shift its factory to Rupganj, Narayanganj to fulfill their objective to export quality products.

Mergers are most commonly done to gain market share, reduce costs of operations, expand to new territories, unite common products, grow revenues, and increase profits—all of which should benefit the firms’ shareholders.

The previous capacity of SF Textiles Industries was 42,250 spindles Cotton, Viscose and CVC yarn spinning. Although, after the merger, Far Chemical will take over all assets and liabilities of SF Textile Industries.

Far Chemical is a concern of Far Group which has two other firms- ML Dyeing and RN Spinning Mills which are listed in the capital market.

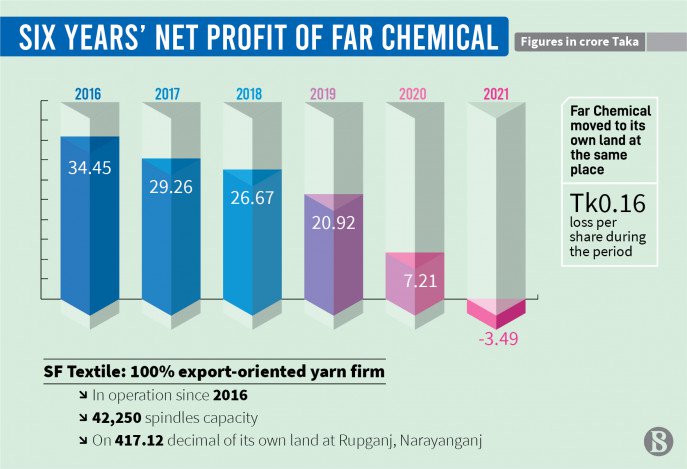

During the Year, Far Chemical posted a loss of Tk 3.49 crore, which was Tk 7.21 crore in the previous year. Consequently, its loss per share was Tk 0.16 which was Tk 0.33 in 2020.

The paid-up capital of the company is Tk 218.09 crore. Paid-up capital is the amount of money a company has received from shareholders in exchange for shares of stock. Paid-up capital is created when a company sells its shares on the primary market directly to investors, usually through an initial public offering (IPO).

Until September, the sponsors and directors jointly held 30.24% shares, institutions held 14.80% shares and the general public held 54.96% shares in the company. The last trading price for shares in the company at the Dhaka Stock Exchange was Tk 12.70 on Monday.

Source: The Business Standard

Leave a Reply