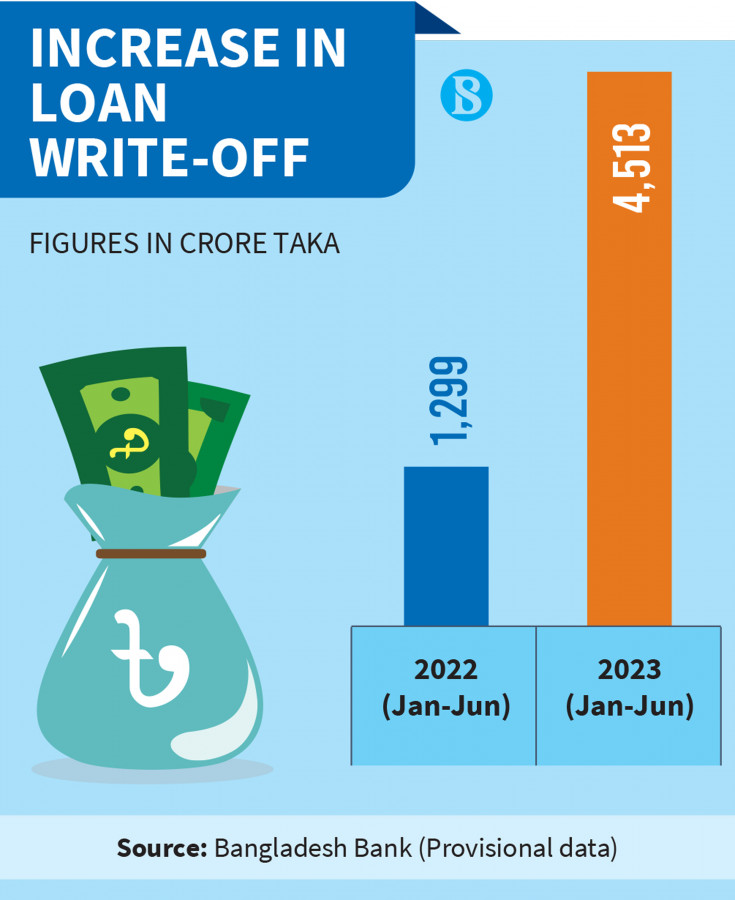

Loan write-offs have increased by over three times during the first six months of 2023

Summary:

In the first half of this year, banks wrote off loans three times more than the same period in the previous year. This indicates that banks are facing a growing number of defaults and financial challenges from borrowers, which could have serious implications for the overall stability of the banking industry.

Content:

Defaulted loans are on the rise due to a growing practice of taking out loans from banks without any intention to repay them. Between January and June, there has been a 247% year-on-year rise in the amount of loans written off, which totaled Tk 4,513 crore, based on data from the Bangladesh Bank. Zahid Hussain, formerly a lead economist at the World Bank’s Dhaka Office, stated that the increase in written-off loans is a direct result of the growing number of defaulted loans in banks.

It has been pointed out by an economist that banks may have the opportunity to understate their default loans by removing the worst-quality defaulted loans from their main balance sheet. As per regulations, a financial institution has the authority to cancel only those loans or investments that are deemed improbable to be recovered and have been classified as “bad” or “loss” – the most severe type of classified loan, for a minimum of three years. The loans that have been written off by banks are recorded separately in a ledger book. However, banks are not authorized to write off loans and investments partially.

Banks are required to set aside a certain amount of money, called provisions, to cover the risk of loans that may not be repaid. The amount of provisions varies depending on the type of loan and whether it is in default. If a loan is written off, the entire amount must be kept as provision. By the end of June 2022, the central bank’s records reveal that loans worth Tk 67,721 crore had been written off. Over the course of 19 years, from 2003 to 2022, the amount of Tk 20, 828 crore has been recovered, leaving net written-off loans of less than Tk 47,000 crore.

According to the central bank, defaulted loans increased by Tk 24,418 crore in the April-June quarter of this year, bringing the total default loan in the banking sector to Tk 1,56,039 crore in June. This amounts to 10.11% of the total outstanding loans. Moreover, if written-off loans are considered, the default loans of the banking sector will exceed Tk 2 lakh crore. As of June 2023, the money-loan courts are facing a total of 72,891 cases, with Tk 189,668 crore being held up in these cases. Most of these cases involve default and written-off loans. Unfortunately, many of these cases have been ongoing for several years, leading to a lack of progress in debt recovery and an increase in the number of defaulters. This situation poses a significant challenge to debt recovery efforts and requires a careful and strategic approach.

Article and Picture Sources: The Business Standard

Leave a Reply