Non–performing loans rise through the extension of the Loan Moratorium Support

Summary:

The expansion of the repayment deferral support by the central bank has resulted in the rise of the Non-Performing Loans (NPL)s in the first quarter of this year. It is stipulated that the facility has been misused by the habitual defaulters which were provided to the pandemic-hit-borrowers. Banks should take some effective measures to cope up with the economic slowdown situation.

Content:

The reason behind banks giving loans is to get back the money with some sort of interest as profit within the repayment schedule. If they cannot recover money from the exceeding client number they had precaution for in due time, then it creates a serious problem in running banking operation.

As a normal precaution by the banks, the provision is normally 1.0 percent against all advances as due to many reasons there might be non-performing loans. An NPL is a loan in which the borrower is default and hasn’t made any scheduled payments of principal or interest for some time. The International Monetary Fund considers loans that are less than 90 days past due as nonperforming if there’s high uncertainty surrounding future payments.

So, the number of loans that fall under the category of classified loans are called non-performing loans. In the classified loans, the banks fail to collect either the interest or the principal amount or both from the borrower. This NPL ratio is higher in Bangladesh compared to the International level which is almost 2.0 percent or below.

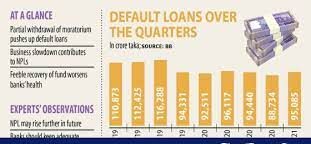

Whereas in Bangladesh, NPLs stood at Tk 95,085 crore in March, up 7.1 percent from three months earlier and 2.8 percent year-on-year, data from the Bangladesh Bank showed. The ratios were 10.30 percent in 2018 and 9.32 percent in 2019.

However, the ratio changed from the last year in March, when the central bank allowed the borrowers who took three categories of loans- term, demand and working capital to perceive the loan deferral support. As a result, default loans went up substantially within April this year and prevented the downgrading of borrowers.

The loan moratorium facility was introduced last year to help out the businesses to cope up with the unprecedented covid crisis and continued in the first quarter of this year as the situation got no better. The defaulted loans accounted for 8.07 percent of the outstanding loans of Tk 11,77,658 crore in the banking industry in Bangladesh in March. The ratio was 7.66 percent in December.

As Businesses might go through the same slowdown situation in the coming months, the Banks should fortify their provisioning base to absorb the shock, as stipulated by Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh who is also a former officer of IMF.

Nearly 49 percent of the defaulted loans belonged to nine state-run banks, whose NPLs grew 2.59 percent to Tk 47,537 crore in January to March quarter, compared to the previous quarter. The bad loans in 41 private commercial banks were up 3.64 percent at Tk 45,090 crore. The NPLs for nine foreign banks rose to Tk 2,458 crore from Tk 2,038 crore during the period.

To control NPL, banks might take several measures as suggested by Tanzirul Islam who is Vice president at Credit Rating Information and Services Ltd.

Some of these are, as following:

1. The banks should strengthen their corporate governance

2. The banks need to research more on risk management activities.

3. They should follow objective-oriented governance practice.

4. They should avoid undue influence and strictly follow banking rules and regulations

5. They should deeply analyze the borrowers in terms of the viability of the business/project, their marketing strategy of the business, working capital requirements etc

6. They can review the repayment behavior of the borrower based on their experience and the attitude of the management of their business.

Picture and Article source :

https://www.thedailystar.net/business/news/bad-loans-rise-payment-holiday-ends-partially-2111873 https://thefinancialexpress.com.bd/economy/bangladesh/banks-non-performing-loans-shrink-thanks-to-moratorium-1612923203

Leave a Reply