Physical presence of chairman & MD mandatory at AGMs, decision taken by BSEC

Summary

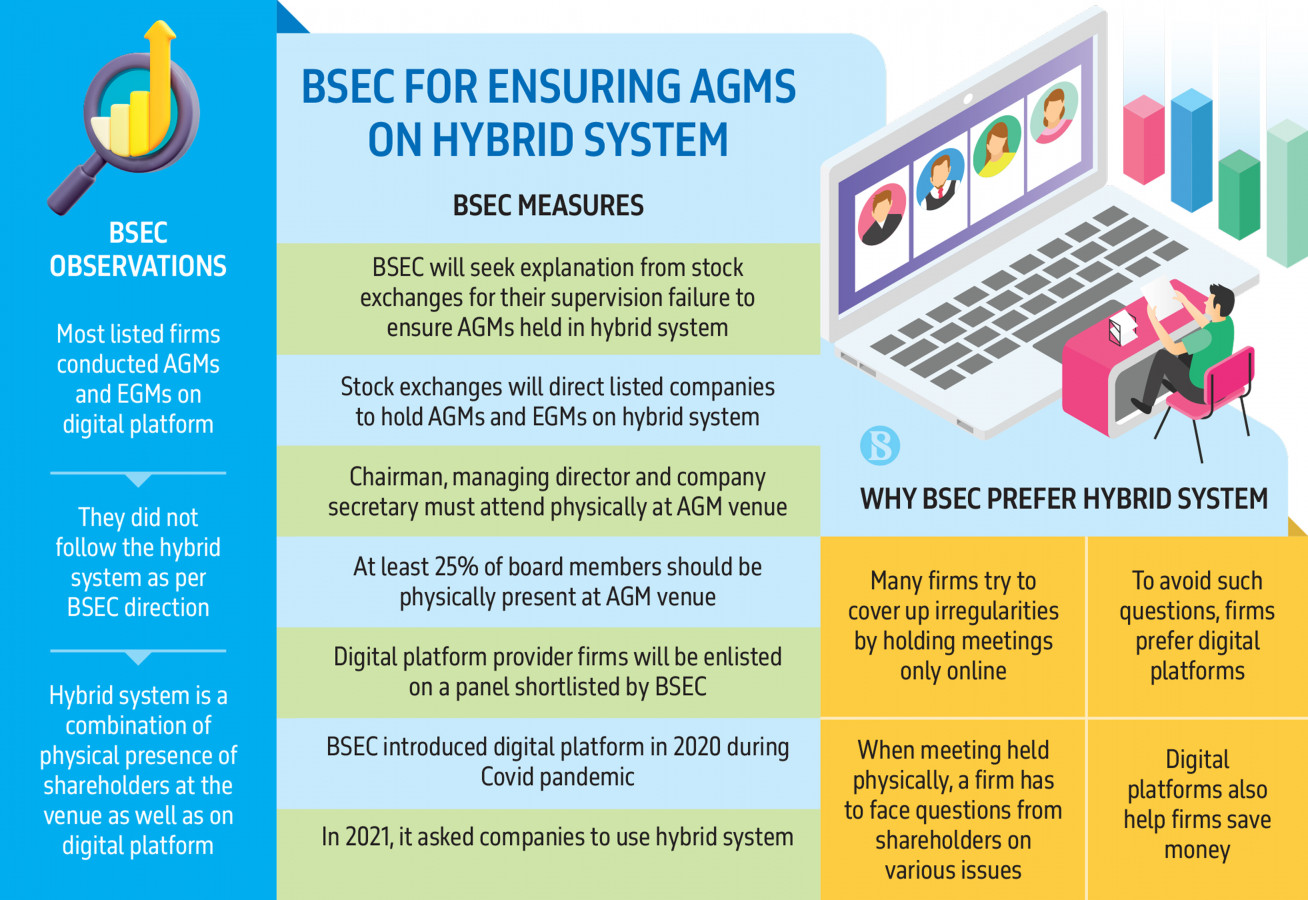

The regulatory body of the stock market has made it compulsory for a listed company to have at least 25% of its board members, including the chairman and managing director, physically present at the general meeting. This is to ensure that the company is accountable to its shareholders.

Content

On December 28th of the previous year, the Bangladesh Securities and Exchange Commission (BSEC) issued a directive to listed firms requiring them to hold their annual general meetings (AGMs) and extraordinary general meetings (EGMs) in the physical presence of shareholders. The commission’s decision was based on its observation that a majority of companies were conducting their general meetings solely through digital platforms, which was in contravention of its instructions, according to sources at the BSEC.

The BSEC has released guidelines for holding AGMs and EGMs. These guidelines introduce a hybrid system that allows listed firms to conduct meetings with both physical and online participation from directors and shareholders. According to sources from the BSEC, the commission has noticed that companies are holding general meetings without following the hybrid system due to the lack of supervision from stock exchanges. As a result, the commission is planning to ask both Dhaka and Chittagong bourses to explain their negligence. According to industry experts, it has been observed that certain companies are leveraging online meetings as an opportunity to conceal any irregularities they may have committed. This is because, during in-person meetings, shareholders tend to raise queries on a variety of issues, thereby necessitating the company’s response and accountability.

Companies accused of manipulations in the capital market are ignoring the guidelines established by the BSEC, to avoid facing accountability for their actions. This tendency is particularly pronounced in cases where companies are exploiting the opportunity to misuse the system. In 2020, due to the outbreak of coronavirus in the country, the regulatory authority mandated that all types of meetings, including AGM and EGM, should be conducted via an online platform.

An anonymous member of the Bangladesh Association of Publicly Listed Companies stated that digital platforms provide an effective and convenient means for shareholders to participate in general meetings while retaining anonymity. Furthermore, utilizing digital platforms is also cost-effective for companies as hybrid systems can incur higher expenses that many businesses may find challenging to bear.

The member also noted that some companies pass agenda items without giving shareholders an opportunity to express their views through digital platforms. However, when the meeting is held in person, it is not feasible to dismiss shareholder participation, as their contribution is vital to the decision-making process.

It is worth considering the benefits of digital platforms for conducting general meetings, particularly in light of the COVID-19 pandemic and the need for social distancing. However, it is equally crucial to ensure that all shareholders have an equal opportunity to participate and that the process remains transparent and fair.

Picture and Article Source: The Business Standard

Leave a Reply