The DSE is developing an advanced system to ensure accurate company disclosures

Summary

The Dhaka Stock Exchange (DSE) has announced plans to create a sophisticated platform that will focus on ensuring accurate disclosures by listed companies. The aim is to prevent the dissemination of misleading information.

Content

The newly appointed managing director of the country’s leading bourse, ATM Tariquzzaman, unveiled this initiative during a program on Tuesday. He emphasized that the current manual process of disclosures and circulation is prone to errors.

During the “CMJF Talk” held at the Capital Market Journalists’ Forum (CMJF) office in Dhaka, the speaker stressed the importance of increased transparency and investor trust. To achieve this, he discussed a plan to establish advanced infrastructures that will enable timely disclosures. The event was chaired by CMJF President Ziaur Rahman and facilitated by General Secretary Abu Ali.

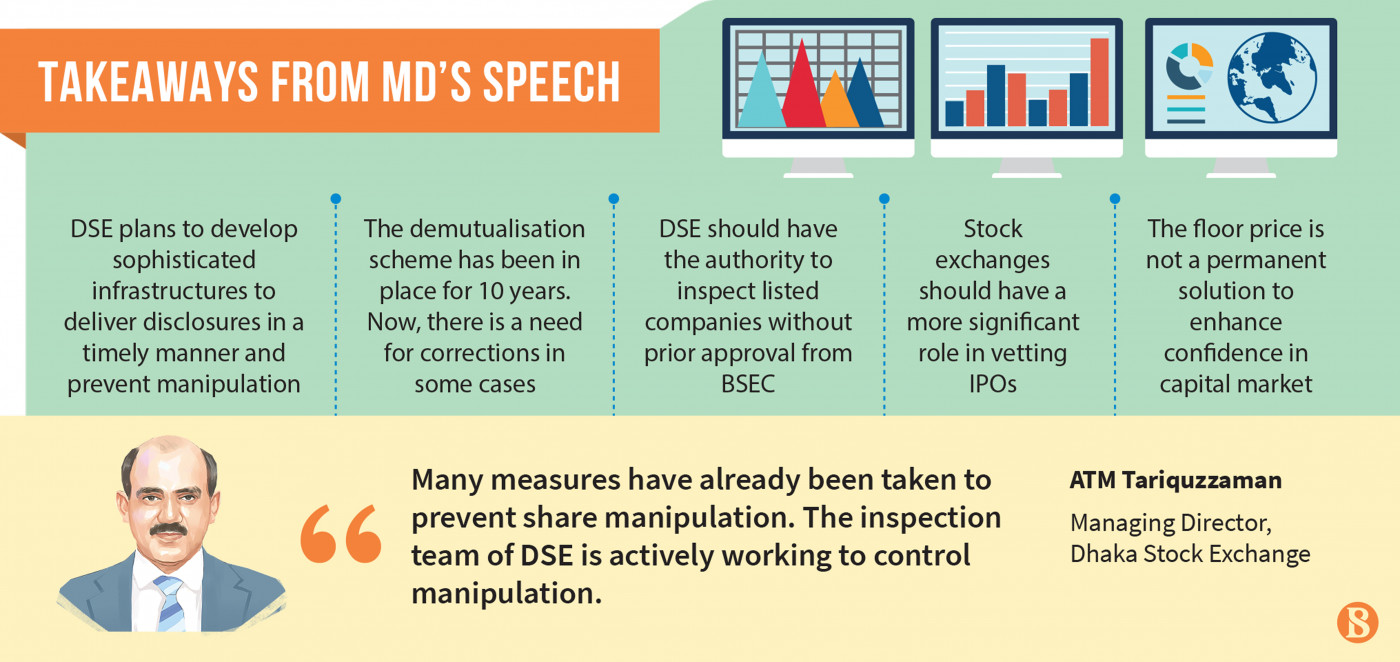

During a recent session, ATM Tariquzzaman, who is currently serving as the executive director of the Bangladesh Securities and Exchange Commission (BSEC), discussed the current state of the stock exchange and shared several plans for its development. ATM Tariquzzaman proposed that the demutualization scheme, which separated the management and ownership of the stock exchange back in 2013, be reviewed. He recognized the need for adjustments, stating that he preferred individual directors to primary shareholders when it came to managing the stock exchange, and announced plans to launch a review of the scheme. The managing director further emphasized that it was essential for the DSE to have inspection authority without requiring approval from the BSEC.

ATM Tariquzzaman recently shared his opinion on how stock exchanges can help ensure that companies listed on them are trustworthy. He suggested that stock exchanges should have more power when it comes to checking whether companies are suitable for public investment. Currently, a regulatory body called the BSEC approves all types of public investments, including IPOs, instead of stock exchanges. Tariquzzaman also had concerns about the use of floor prices as a way to build trust in the stock market. He thinks that this is not a permanent solution, and he was against regulators or stock exchanges fixing prices because it is not a common practice globally.

The managing director of the Dhaka Stock Exchange (DSE) recently spoke about the important role of the stock exchange in determining prices. He also talked about a partnership with two stock exchanges in China, and mentioned some technical details that were agreed upon. However, the implementation of these agreements has been delayed due to the pandemic. The managing director also expressed concern about the DSE being audited by the same auditor for 36 years, as this could affect the impartiality of the audit. He stressed the need for auditor rotation to ensure good governance. Finally, the managing director highlighted the challenges that the DSE faces in combatting market manipulation, and called for the exchange to have more authority in this area. Currently, this authority is held by the Bangladesh Securities and Exchange Commission (BSEC).

Picture and Article Sources: The Business Standard

Leave a Reply