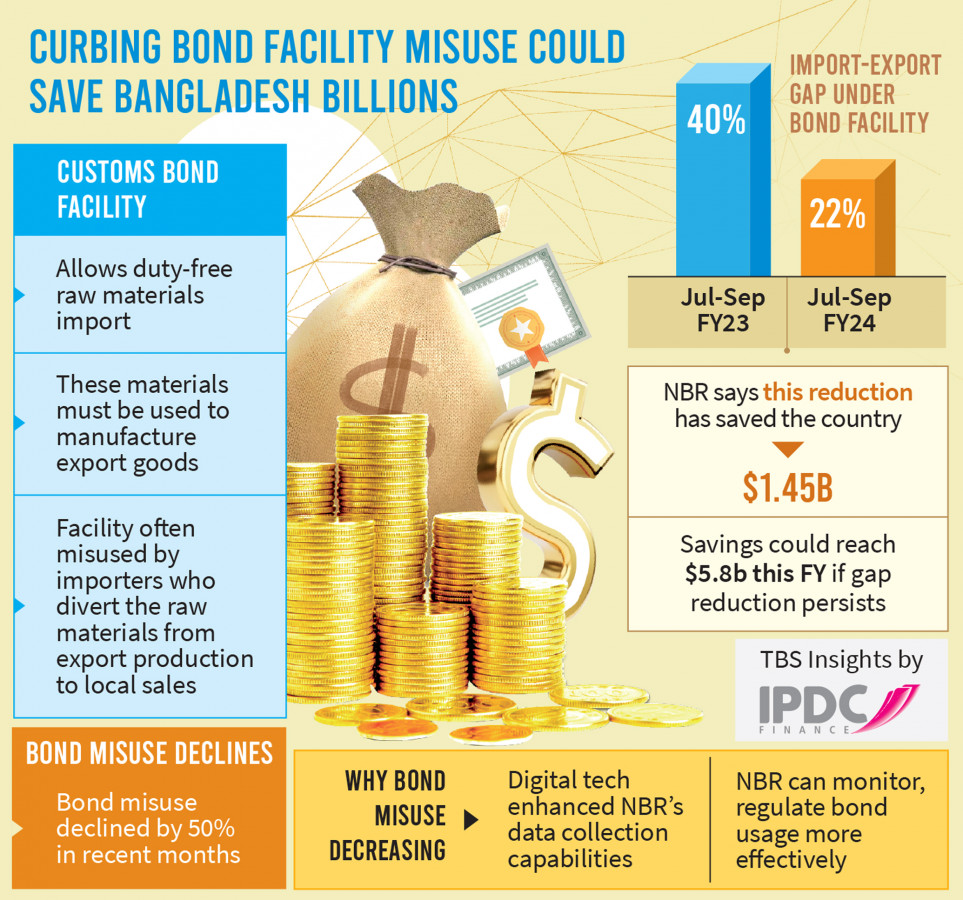

The misuse of bonds has nearly halved in Bangladesh, resulting in savings of $1.45 billion during the period of July to September

Summary

The government granted tax concessions of approximately Tk1 lakh crore on raw material imports under the bond facility in FY2022-23, resulting in a reduction worth $1.45 billion in the first quarter of the present financial year. During the first three months of the current fiscal year, the misuse of bond facilities, which offer import duty concessions for raw materials utilised in export-oriented sectors, decreased by 50%.

Content:

According to the National Board of Revenue (NBR), the government provided approximately Tk 1 lakh crore in tax concessions on raw material imports under the bond facility in FY2022-23. As a result, the value of this reduction is worth $1.45 billion in the first quarter of the current financial year. Customs data shows that the gap between raw material imports and the export of goods manufactured from these materials has decreased to 22% in the first three months (July-September) of FY24. This is a significant improvement from the 40% gap observed in the corresponding period of FY23 and an even more substantial 45% two years ago. Customs officials credit the use of digital technologies for improving the trade data collection and analysis capabilities of the NBR. The Customs Department’s software, ASYCUDAWorld, has been integrated with various institutions, including banks involved in import and export activities. This has allowed the revenue board to regulate the use of bonds. According to customs data, from July to September of FY23, 14 lakh tonnes of raw materials were imported under the bond facility, and 8.30 lakh tonnes were exported during the same period. The gap between imports and exports was about 5.5 lakh tonnes. Around 10.18 lakh tonnes were imported in the initial three months of FY24, while exports amounted to roughly 8 lakh tonnes, indicating a reduction in the difference between the two.

The customs department has announced that we are now importing and exporting goods in a way that is more balanced. This has resulted in benefits worth $1.45 billion, which is equivalent to Tk16,000 crore. If we can continue this trend throughout the year, we could save up to $5.8 billion. A senior customs official said that they are confident that this is a positive development. They have excluded some types of goods from their calculations, but overall, things are looking good. The official also said that the misuse of bonds is declining significantly, which is also a positive sign.

The customs department has been examining data from various sources, including its own ASYCUDA World software, utility declaration (UD) information provided by exporters, and other import and export documents, as reported by sources. After conducting a thorough review, irregularities have been identified in over a hundred manufacturing companies.

Currently, there are 8,000 bond license holders in the country, with around 5,000 of them being active, according to the sources. Importers would face around 50% taxes on imported goods or raw materials without the duty-free bond facility. Importers can bring in raw materials without paying import duties under the bond facility, provided they use these materials to manufacture goods for export. However, some importers have misused the facility, such as selling raw materials to local companies that cannot import the products under the bond facility. The government has been waiving taxes on imported raw materials to help exporters in the country compete in the global market, with the condition that the imported raw materials are kept in a specific warehouse and all products made with them are exported. This facility, known as the Bonded Warehouse Facility, has been available to the government since the 1980s. If these products are sold in the local market, the applicable tax must be paid. However, the lack of strict monitoring has led to allegations of raw materials being imported under duty-free privileges and then diverted to the local open market, instead of being used to make export products. “A reduction in duty-free imports leads to an increase in commercial or tax-paid imports,” said the NBR official, addressing the advantages of reducing the import-export gap under the bond facility.

According to Mr. Farid Uddin, a former member of the customs policy board, the recently proposed calculation suggesting a reduction in the import-export gap and saving the country $1.45 billion or $6 billion at the end of the year should be taken with a grain of salt. However, it is true that there are fewer irregularities in the bond system. Mr. Uddin pointed out the prevalence of irregularities among local companies producing accessories under back-to-back letters of credit and emphasized the potential benefits of integrating their Utility Permissions online. Mohammad Hatem, executive president of Bangladesh Knitwear Manufacturers and Exporters Association (BKMEA), welcomed any practical steps to prevent abuse, but he also stressed the importance of ensuring that genuine exporters are not harassed or harmed. Mr. Hatem also raised concerns about alleged harassment of exporters by customs authorities at the port.

Picture and Article Sources: The Business Standard

Leave a Reply