Universal Pension Scheme in 6-12 months

SUMMARY: Bangladesh to embark on the long-anticipated universal pension scheme within 6 months to 1 year which will be open to all save the public servants.

The government chalks out to launch the universal pension scheme in order to maintain its pledge of providing a safe and sound life to senior figures, particularly after the age of 60 which is the age of retirement.

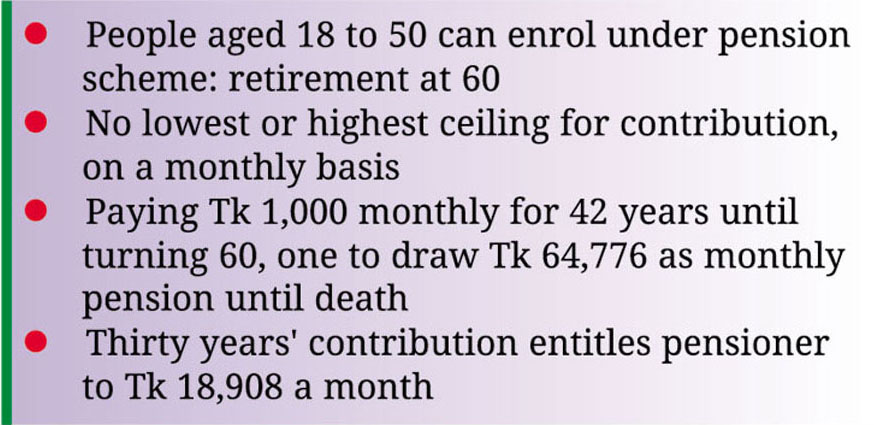

Among divulging other information about the pension system, Finance Minister AHM Mustafa Kamal, mentioned that the citizens aged between 18 and 50 could associate themselves with it by chipping in a certain amount of fees.

He uttered that the present life expectancy of the people of Bangladesh is 73 and that it is apprehended to reach 80 by the year 2050 and 85 years by 2075. Hence, this anticipation of longevity exhibits that an employed person will live for around 20 years after their retirement, as per the finance minister. This will then result in a surge of dependency ratio of up to 24% in 2050 and 48% in 2075 which is currently 7.7%.

Ergo, a consolidated pension scheme is much needed for the country, after taking into account the above details, so as to secure the lives of the elder citizens in future.

He further added that the pension scheme is analogous to contributory provident funds with no minimum or maximum ceiling for contribution.

Nonetheless, employees of government or autonomous bodies are not entitled to engage in the mentioned scheme. Whether they will be allowed to enter the horizon of it will be decided by the government later in the future.

At the outset, the enrolment will be at the discretion of each individual, however, the government will make it compulsory for everyone later on.

In order to open an account for a pension, it is a prerequisite for citizens to have a national identity card. Each individual must have their own independent account so that it does not create any problem in the future even if they change their professions.

For the purpose of being entitled to a monthly pension, citizens ought to contribute for a minimum of 10 years. They must deposit their contributions on a monthly basis. However, non-native workers may deposit it every three months.

Failure to deposit the minimum yearly contribution will result in his/her pension account freezing. Only depositing the money with late-payment fees will lead to a resurgence of the account.

In addition, the government will also contribute with an amount that is equivalent to that of an enrolled citizen.

As soon as a person retires at the age of 60, he/she will start receiving their monthly pension. The amount will depend on each individual’s contribution and the amount of interest that has been incurred. An enrolled citizen will continue receiving this annuity till death.

In a case where the pensioner may depart his life before the age of 75, his/her nominee will be entitled to receive the amount for the number of remaining days. Furthermore, if a citizen dies prior to the completion of a contribution of 10 years, the nominee will get the amount of money that was deposited along with interest.

Mr. Kamal, as an illustration, articulated that if a citizen starts contributing an amount of Tk.1000 per month from the age of 18 until 60, he/she will get Tk.64,776 on a monthly basis till death. Thus, if a pensioner pays a bigger sum of money every month, the rate of his/her monthly pension will also shoot up simultaneously.

Mr. Kamal also stated that the government will look over the pension schemes of the vicinal countries and will then set the seal on the most appropriate mechanism.

SOURCE: The Financial Express

Leave a Reply