SEMINAR ON VAT, TAX & CUSTOMS DISPUTES

VAT, Tax and Customs related legal disputes are complex & often require specialized knowledge. There are different forums available for resolution of disputes. One of the big challenges involving taxation matters is that the laws & regulations are constantly changing.

Under the Finance Act 2023 a new income tax at source on transferring of property is now payable. A new digital services tax will be levied on the income of MNCs that provide digital services to users in Bangladesh. A new tax on cross-border data flows will be levied on the transfer of data between MNCs and their affiliates in other countries.

Under the new Income Tax Act of 2023, the changes are expected to have a significant impact on taxpayers, businesses, and the government. Some of the key changes include increased tax slabs, increased tax rates on dividends and capital gains, new tax incentives for businesses e.g., increased investment allowance, new tax credit for research and development.

On the other hand, the section 73 and 85 of VAT Act 2012 has been amended by the Finance Act 2023 to blend the requirement of giving a show cause notice and an opportunity of being heard for both questions involving accuracy of the return etc. (under section 73) and monetary penalties for non-compliances or irregularities (under section 85).

Similarly, the Customs Act, 1969 has been amended by Finance Act 2023 to add a new definition of bill of entry to incorporate ex-bond bill of entry. The Act added a new requirement to submit an ex-bond bill of entry in such form and manner as prescribed. Fifteen days’ prior permission is needed from the Commissioner of Customs (Bond), or any other Commissioner of Customs authorized by the Board for clearing the goods to special bonded warehouses for special purposes as defined.

We will discuss the recent changes & also common legal disputes involving Vat, Tax & Customs matters. Participants are required to join physically. Please note we have limited space for physical participation. The Seminar will be conducted on the 26th July, 2023 (Wednesday) from 3.30pm to 5.00pm at Rahman’s Chambers, Motijheel Branch, 8th Floor, Malek Mansion, 128, Motijheel C/A, Dhaka-1000.

Join the event to enhance your knowledge and make yourself aware of the current legal issues.

Speaker

Mr. Mohammed Forrukh Rahman

Head of Chambers, Rahman’s Chambers

Divisional Head, Dispute Resolution, Shipping & International

Barrister-at-Law of Lincoln’s Inn, London

LL.M.(International Dispute Resolution) (Uni of London)

PGDipLaw (Maritime) PGCertLaw(Commercial & Corporate),

Fellow, Hong Kong Institute of Arbitrators (FHKIArb),

Member, ICC Commission on Arbitration & ADR, Paris,

Panel Arbitrator, SARCO, SCIA, Member, NYSBA, SCMA,

MSIArb(Singapore), CIArb, CEDR(UK) Accredited Mediator

Advocate Supreme Court of Bangladesh.

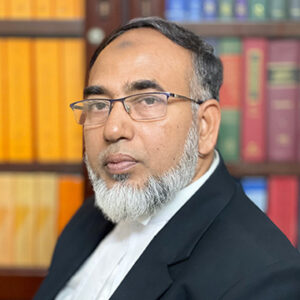

Speaker

Mr. Md. Abdul Khaleque

Divisional Head, Corporate and Finance Division,

Senior Member, Investment and Business Set Up Team

Rahman’s Chambers, Headquarters

LL.M from Islamic University Kushtia

LLB from Islamic University Kushtia

Advocate, Supreme Court of Bangladesh

Speaker

Mr. Sadiqul Islam Chowdhury

Associate

Member, International, Taxes & Finance Department.

Member, ADR, Land and Tribunal Team

Rahman’s Chambers, (Headquarters)

LL.M, Eastern University

LLB, University of London

Time Schedule

Time : 3:30 pm to 5:00 pm

Date : 26th July 2023 (Wednesday)

Booking Instructions:

- Please register for our event as indicated below. Also indicate it you are joining physically/ virtually. We will send you registration confirmation by email/SMS.

- Materials will be provided at the time of the session.

- There is no fee for attending the above event.

For Physical participation

- Advance booking is recommended.

- Bookings are made on First come first serve basis.

- Priority is given to Past/Present Clients in Booking.

For Registration:

Mobile: (+88) (0)1788626815

Email: communication@rahmansc.com,

Click here to Register

Organized By:

Rahman’s Chambers, Motijheel,

Rahman’s Chambers, Motijheel Branch, 8th Floor Malek Mansion 128, Motijheel C/A Dhaka-1000.

Email: motijheel@rahmansc.com, Phone: (+880) 1788626816

www.rahmansc.com

Leave a Reply